Property Tax Utah

Utah Property Taxes – Utah State Tax Commission

Official site of the Property Tax Division of the Utah State Tax Commission, with information about property taxes in Utah.

https://propertytax.utah.gov/

Utah Property Taxes By County - 2022 - Tax-Rates.org

The median property tax in Utah is $1,351.00 per year for a home worth the median value of $224,700.00. Counties in Utah collect an average of 0.6% of a property's assesed fair market value as property tax per year. Utah is ranked number thirty two out of the fifty states, in order of the average amount of property taxes collected.

https://www.tax-rates.org/propertytax.php?state=utah

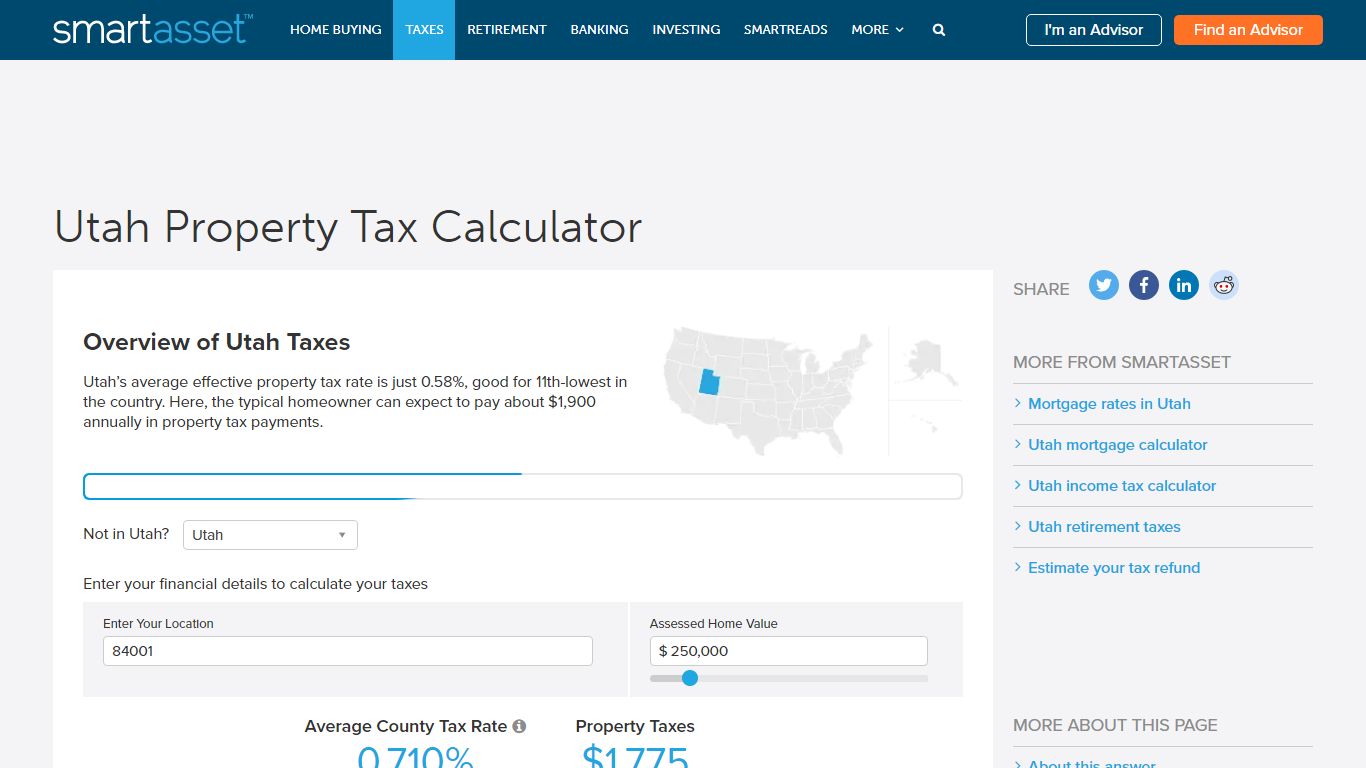

Utah Property Tax Calculator - SmartAsset

Residential property in Utah receives a 45% property tax exemption. Thus, if the market value of your home is $100,000, the taxable value is just $55,000. Your local tax rates apply to that taxable value. Utah Property Tax Rates. There are more than 1,000 different property tax areas in Utah, each with a separate rate.

https://smartasset.com/taxes/utah-property-tax-calculator

Residential Property - Utah Property Taxes

Residential property tax in Utah is administered by the 29 county governments. The counties’ role begins with the surveying and/or recording of real property ownership records. It continues with the valuation, assessment, and equalization of property values. It ends with the collection of property taxes and the distribution of revenues to the ...

https://propertytax.utah.gov/locally-assessed/residential/

Property Tax Relief

General Information. Tax Relief Table. The following information can assist those needing property tax relief in Utah. It is provided for reference and is not an exhaustive list of resources. Most individual taxpayer issues and questions about tax relief are handled by your local county officials. Please visit this page to find the contact ...

https://propertytax.utah.gov/tax-relief/

Tax Relief FAQ - Utah Property Taxes

If the taxpayer is seeking an armed forces exemption, as a veteran claimant or active duty claimant, they are still eligible if they acquire the property after January 1 in the year the relief is claimed. Note about property tax deferral programs: Authority to grant tax deferrals exists under Section 59-2-1802, and Section 59-2-1347.

https://propertytax.utah.gov/tax-relief/tax-relief-faq/

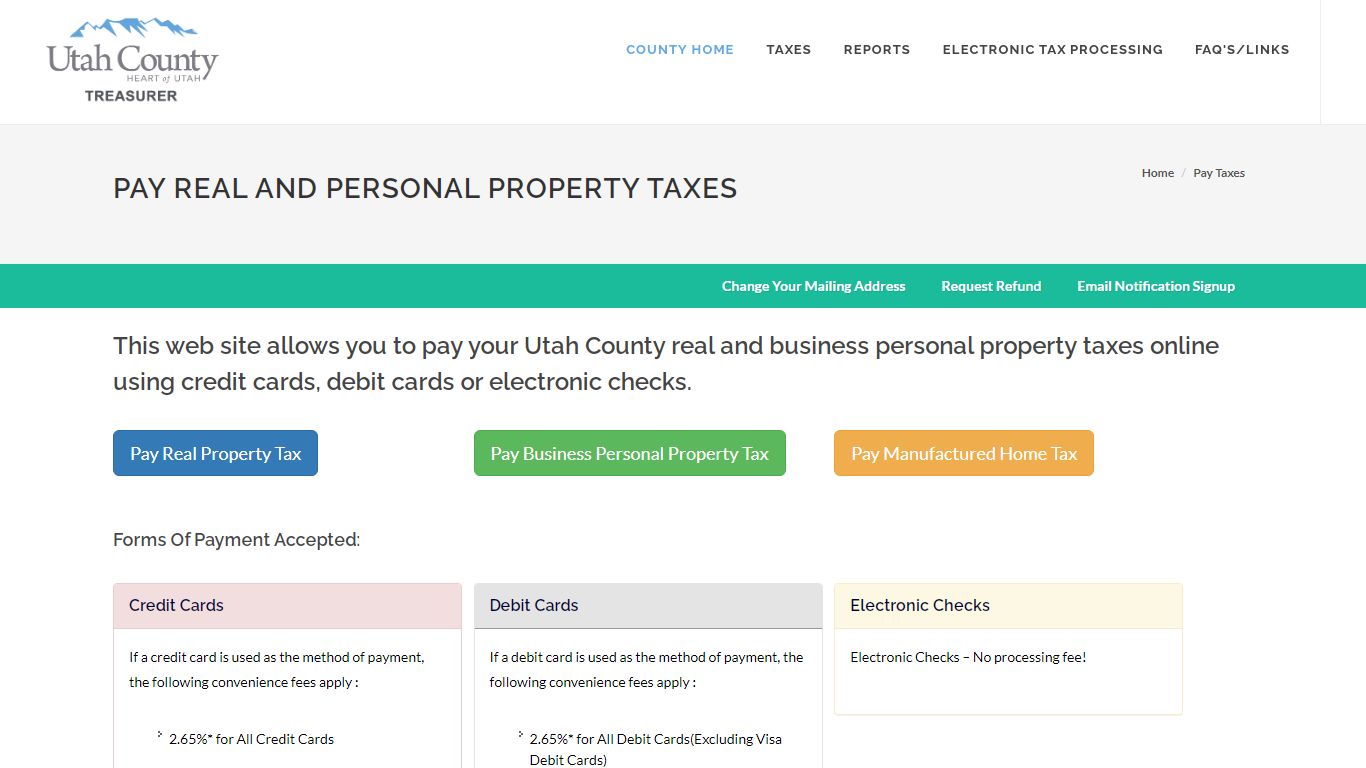

Pay Taxes | Utah County Treasurer

Pay directly to the Utah County Treasurer located at 100 E Center Street Suite 1200 (main floor) Provo, UT. (Please note that our offices will be closed November 25 and November 26, 2021 for the Thanksgiving Holiday.) Pay over the phone by calling 801-980-3620, Option 1 for real property; What you need to pay online : To pay Real Property Taxes :

https://www.utahcounty.gov/Dept/Treas/Taxes.html

Property Tax | SLCo - Salt Lake County, Utah

The value and property type of your home or business property is determined by the Salt Lake County Assessor. Residential property owners typically receive a 45% deduction from their home value to determine the taxable value, which means you pay property taxes on 55% of your home's value.

https://slco.org/property-tax/

Utah housing market: The dark side to higher home values is in your tax ...

Rising property values in Utah have led to property tax hikes as well. (Photo: Ben B. Braun, Deseret News) Cox's property tax notice showed his home's full market value went from $624,900 in 2021 ...

https://www.ksl.com/article/50455344/utah-housing-market-the-dark-side-to-higher-home-values-is-in-your-tax-bill

Property Taxes - Davis County, Utah

We encourage payment of property taxes on this website (see link below) or IVR payments at (877) 690-3729, Jurisdiction Code 5450. ... Farmington, Utah 84025 Mailing Address Davis County Treasurer P.O. Box 618 Farmington, Utah 84025-0618 Phone Numbers 801-451-3243 :: Main 801-451-3111 :: Fax Hours

https://www.daviscountyutah.gov/treasurer/property-taxes